The Reinsurance of Global Warming

By Thomas Klikauer

There is no insurance for global warming. Nor is there a reinsurance against the devastating impact of global warming.

With billions of dollars at stake, reinsurance corporations are keen observers of global warming. Here is why and what we will have to expect if the world continues, as António Guterres, Secretary-General of the United Nations, recently said,

Greenhouse gas emissions keep growing.

Global temperatures keep rising.

And our planet is fast approaching tipping points that will make climate chaos irreversible.

We are on a highway to climate hell with our foot on the accelerator.

The impact of global warming will hit homeowners, too. Many of those who own a house, car, etc. like to take out insurance to safeguard their possessions. This protects from financial loss: in exchange for a fee or charge, an insurance company agrees to compensate another party (you) in the event of a certain loss, damage, or injury.

Insurance corporations take a risk, but they hope never to have to pay for your loss. This is a gamble, a bet, a kind of risk management. It is managing a risk in the hope that nothing happens, and the corporation cashes in year after year after year as you pay your annual fee to them. Whether a small local company or a large multinational corporation with shareholders, a firm that offers insurance is known as an insurer, insurance company, insurance carrier, or underwriter.

You – as the one who buys insurance – are known as a policyholder. To make the entire setup a bit more complicated, insurance companies like to insure themselves against potential payouts. They hedge their own risk by taking out an insurance themselves. Insuring themselves with an “other” company is known as reinsurance.

In short, another corporation or insurance company agrees to carry some of the risks for the prime company – the insurance company that has insured your house, for example. These insurance companies do that when the primary insurer – the one that insures your house, for example – deems the risk too large for it to carry.

This is particularly the case when such a primary insurer insures many houses in a particular area. This is where so-called reinsurance corporations enter the picture. If your insurance company pays for damage done to your house only – one single house – it can cover that.

But when a flood or storm hits your area, that insurance company relies on a reinsurance company as the cost of payouts to many homeowners can be stratospheric.

In 2021, the global reinsurance market was a whopping $306bn, or $306,000,000,000 – the entire budget of a country the size of Brazil. In other words, reinsurance means serious money.

All this means that reinsurance corporations are very interested in assessing global risks, as well as forecasting and predicting the likelihood of weather events. In other words, reinsurance corporations have a very serious interest in something as simple as the weather, i.e., a short-term change, along with climate change and global warming, i.e., a long-term change.

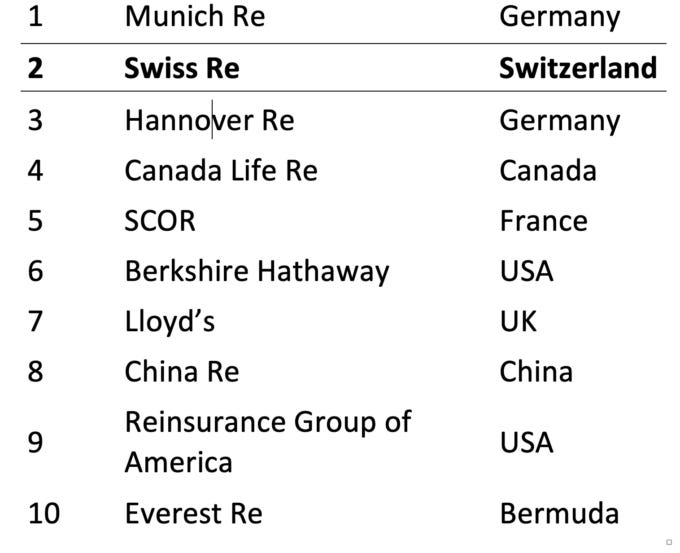

It is for this reason that the top ten reinsurance corporations – unlike global warming deniers – have developed over the years a very keen interest in global warming.

Among the many reinsurance corporations that assess the risk of global warming, Swiss Re’s report on global warming – while being nothing out of the ordinary – is a good example to see what is expected in terms of global warming.

Based on a healthy self-interest, Swiss Re says that it is actively contributing towards the net-zero transition, the reduction of CO2. This is in line with the 2015 Paris Agreement.

Reinsurance corporations do that because global warming means more bad weather events and more destruction of properties – of your house, for example – for which your home insurer has to pay and for which your home insurer is reinsured by Swiss Re or one of the other global operating reinsurance corporations.

For these corporations, global warming is an extremely serious threat that challenges not just their handsome profits but also their very existence. For that reinsurance corporations look at three areas:

1) life and health insurance;

2) agriculture insurance; and

3) property insurance.

In 2020, the global consulting juggernaut McKinsey, for example, thought that “hazards from global warming ’could‘ – conservatively – increase from about 2% of global GDP to more than 4% of global GDP in 2050”.

While 2% or 4% does not sound like much, it will not hit every country in the same way. It means a very serious reduction in wealth needed to pay for the damage done by global warming, at a time when many countries need their wealth most.

Back at Swiss Re, the reinsurance giant has had to cover $3.9 billion in the USA alone for damage done in the course of global warming. Behind what it euphemistically describes as “the market is expected to see strong growth” lurks an awareness that global warming will get worse, not better.

The reinsurance corporation says physical risks posed by global warming could potentially affect three areas:

1) Because global warming will shape the modeling and pricing of weather-related perils, the risk will go up;

2) Global warming will impact the insurability of risks exposed to extreme weather events; in other words, reinsurance corporations will no longer cover the risk for your insurance company, which, in turn, may no longer insure your house; and

3) Global warming is expected to cause a reduction, and even disruption, in how insurance and reinsurance companies operate

The really bad news is in no. 2. It is what is inoffensively called “an impact on the insurability”. This means no more insurance for your house, and if your house becomes uninsurable, you cannot sell it. The biggest family asset is worthless.

Reinsurance corporations have developed mathematical models to assess global warming-related risks. This is called Annual Expected Losses, or AEL. This means loss to you – your house is gone – and loss to them – they have to pay the insurance companythat insures your house.

Reinsurance corporations see two main risks: storms such as tropical cyclones and tornados and flooding. Swiss Re, for example, believes that 50% of the money they have to pay will go to the USA, 18% to Asia, 15% to Europe, and so on.

The reinsurance corporation also believes that rising temperatures due to global warming will occur because of three drivers: a) an increase in average temperature; b) rising sea levels and an increase in storm levels, spiced up by landslides, droughts, water scarcity and wildfires and bushfires; c) this increase will take place over the next decade, with heat waves and drought already “observable”.

Reinsurance corporations are convinced that heat waves are already affecting agriculture, workforce productivity, infrastructure, water resources, health, and mortality. Hot and dry conditions are worsening the impact of drought and risk of wildfires. These changes have been seen in different regions in recent years:

+ California, where the winery of global warming-denier and Fox News owner Rupert Murdoch was scorched as California wildfires ripped through his beloved Bel-Air;

+ Southern Europe, where right-wing political parties still deny that global warming even exists; and finally,

+ Australia, where conservative prime minister John Howard did nearly everything possible to prevent fighting global warming for a decade; another conservative prime minister, Tony Abbott, believed that the science behind global warming was “absolute crap”; and a more recent – also conservative – prime minister, known as Scomo, made a secret Hawaiian escape while substantial sections of his country were on fire.

More bad news is on the horizon. Since most property re/insurance contracts have a duration of one year, updated risk views are quickly reflected in the pricing of natural catastrophe risks, this basically means that, if companies will insure your home at all, it will come at a cost and this cost will go up annually. In plain insurance English:

Larger increases, however, may be pushing re/insurance prices

for certain highly exposed risks beyond the limits of economic viability.

This means no insurance anymore because it is bad business for them, not you. Reinsurance corporations calls this “insurability” – their ability to offer insurance at all. This, of course, depends on the assessment of a risk, and global warming is such a risk.

When risks increase to a level at which corporations deem losses too high, then reinsurance – and thereby insurance of a house, for example – is, no longer the right instrument, i.e., no insurance.

This is particularly true in what reinsurance corporations call “systematic changes to a landscape” – global warming is such a systematic change. When, for example, there simply is too often or even permanent flooding because of rising sea levels, insurance is no longer “appropriate”.

What reinsurance corporations call “appropriate” means, in real life, profits for corporations. Beyond that, “to protect assets” means your asset (your house), but it also means –most importantly – their profits! Giving up on those unprofitable areas might even make reinsurance corporations more profitable.

The Global Economic Forum, known as the Davos meeting and not known as some tree-hugging greens, see 410 million people at risk while C40 thinks this can go up to 810 million. NASA, also not known to be tree huggers, says that immediate hot spots include the US East Coast and Gulf Coast, Asia, and islands. Some parts of Florida, good-bye.

It may well mean that Waterworld is in your backyard. According to Swiss Re, this will be mainly in Florida and the northeastern coast of the USA.

To assess what is coming, reinsurance corporations use scenarios of the Network of Central Banks and Supervisors for Greening the Financial System or NGFS. From this, according to Swiss Re, there are three plausible scenarios in a future that is defined by global warming:

Orderly global warming policy: policies to fight global warming reintroduced early that become gradually more rigorous; net-zero CO2 emissions are achieved before the year 2070 – giving a 67% chance of limiting global warming to below 20 Physical (homes, etc.) and transition risks for reinsurance corporations are relatively low.

Disorderly global warming policy: global warming policies are not introduced until the year 2030. Consequently, emissions reductions will need to be much greater than in scenario 1 (orderly) to limit global warming. This will result is higher transition risk – for reinsurance corporations as well as the general public. In other words, more things will be destroyed.

Hothouse world: Only present-day global warming policies are preserved. This is the business as usual Inevitably, global emissions will grow until 2080, leading to 30C+. Swiss Re’s rather little “+” means global warming of more than 30C. As a consequence, there will be “severe physical risks” for the general public as well as, more importantly for capitalism and reinsurance corporations, severe financial risks for reinsurance corporations.

In the end, the picture being painted by reinsurance corporations – those that will have to pay for the damage caused by global warming and those that inevitably will tell your home insurer that they will no longer reinsure their policies, and therefore your home will be uninsured –is one of The Good, The Bad, and the Ugly.

In other words, with immediate and strong action, we might have a chance (the good); with delayed action on global warming, our future will be bad; and with business as usual, the Earth’s future will be downright ugly.

This article was originally published here.

Thomas Klikauer teaches at the Sydney Graduate School of Management at Western Sydney University, Australia. He has over 600 publications including a book on the AfD.